UK upstream sector remains resilient through turbulent times

The UK upstream oil and gas sector has become leaner and more resilient over recent years, as pullbacks in investment and reduced operating costs has helped provide a stronger cash flow outlook under newly weakened oil and gas prices, says GlobalData, a leading data and analytics company.

Daniel Rogers, Oil and Gas Analyst at GlobalData, comments: “Despite a relatively expensive operating environment, a favorable fiscal regime and vast active infrastructure has helped the UK oil and gas sector to remain attractive.

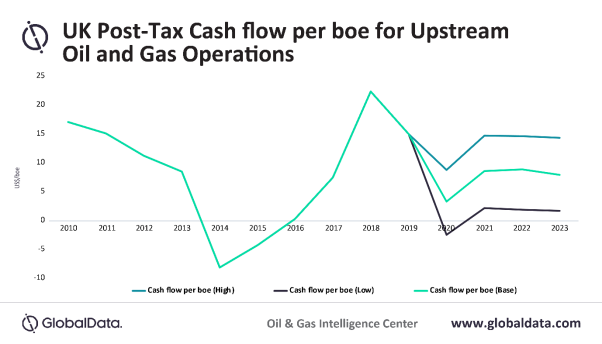

“Under a base case oil price of US$45/bbl for 2020, the outlook for post-tax cash flow/boe is in line with 2013 levels when oil prices were over US$100/bbl. The country has been able to improve cash flow margins as investments are reduced and costs optimized.”

Despite the direct impacts of COVID-19 on the UK oil and gas sector, production levels are expected to remain relatively unaffected in spite of a number of operational assets being hit by related disruptions.

Rogers adds: “The last three years have seen significant field reserves come on-stream in the UK through developments sanctioned prior to the 2014 price crash. The UK has a steady near term production outlook through already sanctioned developments and COVID-19 disruptions are unlikely to drastically hamper 2020 volumes. Despite this, investment in the sector is forecast to dip this year from 2019 levels and the capital expenditure outlook remains particularly weak.”

SOURCE: sweetcrudereport.com